A 1031 exchange, also known as a like-kind exchange, is a tax-deferred transaction that allows real estate investors to sell one investment property and reinvest the proceeds into another “like-kind” property without immediately paying capital gains taxes on the profit from the sale.

Here’s how it works:

- Qualified Properties: The properties involved in a 1031 exchange must be held for investment or business use, such as rental properties, commercial buildings, vacant land, or other types of real estate. Primary residences and properties held for personal use do not qualify for a 1031 exchange.

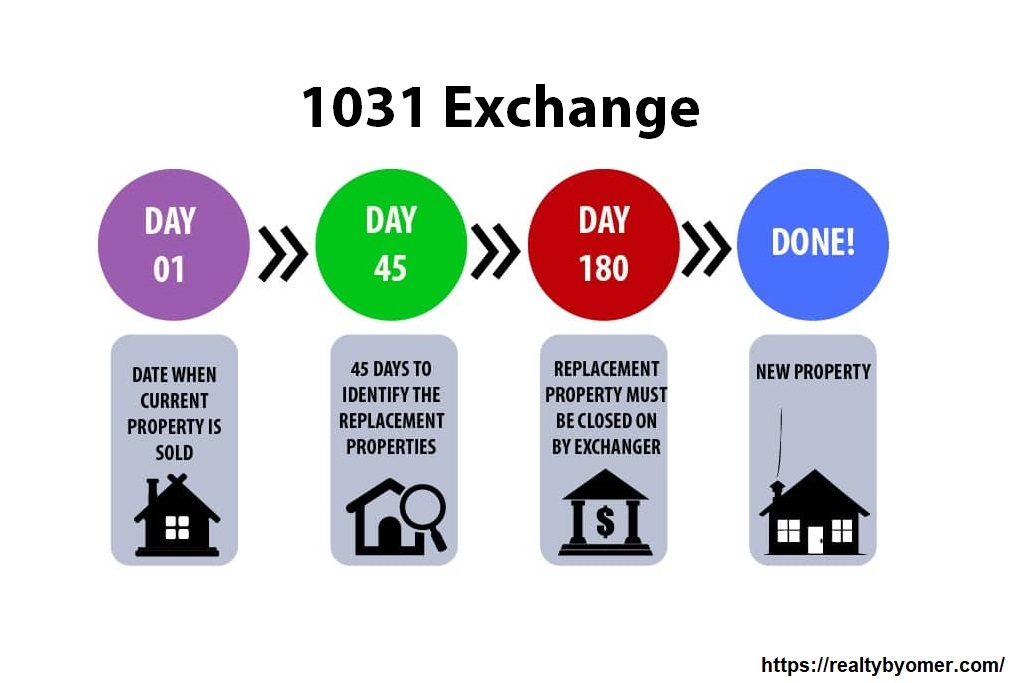

- Timing: To qualify for a 1031 exchange, the seller must identify potential replacement properties within 45 days of selling the relinquished property and complete the exchange by acquiring one or more replacement properties within 180 days of the sale. Strict timelines apply, so it’s essential to adhere to the deadlines to qualify for tax deferral.

- Qualified Intermediary: The seller must work with a qualified intermediary (QI) to facilitate the 1031 exchange. The QI acts as an intermediary or facilitator to ensure that the exchange meets all IRS requirements and that the proceeds from the sale of the relinquished property are properly held in escrow until they are used to acquire the replacement property.

- No Cash or Boot: In a 1031 exchange, the seller cannot receive cash or other non-like-kind property as part of the exchange transaction. Any cash or “boot” received from the sale of the relinquished property may be subject to capital gains tax. To fully defer taxes, the seller must reinvest all proceeds into the replacement property or properties.

- Equal or Greater Value: The replacement property or properties acquired in the exchange must be of equal or greater value than the relinquished property, and any mortgage or debt on the replacement property must be equal to or greater than the mortgage or debt on the relinquished property.

- Tax Deferral: By completing a 1031 exchange, the seller can defer paying capital gains taxes on the profit from the sale of the relinquished property until a later date, potentially allowing for increased investment growth and cash flow. However, it’s important to note that the taxes are deferred, not eliminated, and will eventually be due when the replacement property is sold without being exchanged.

1031 exchanges can be complex transactions with specific rules and requirements, so it’s essential to work with qualified professionals, including tax advisors, attorneys, and qualified intermediaries, to ensure compliance with IRS regulations and maximize the benefits of the exchange in protecting your money. Make sure you have a strong team, including an experienced realtor that can help find your replacement property within the 45 day limit, to ensure success.